Introduction

Beneficial Ownership Filing has become a cornerstone of business compliance in an era where corporate transparency is key to fostering trust and accountability.

The Corporate Transparency Act (CTA), enforced by the Financial Crimes Enforcement Network (FinCEN), mandates this filing to curb financial crimes like money laundering and tax evasion.

For U.S. businesses, understanding and complying with these regulations is not just essential—it’s mandatory.

With the BOI Report Deadlines looming, this comprehensive guide will explore what beneficial ownership filing entails, why it’s critical, and how to stay compliant with FinCEN filing requirements.

We’ll also provide answers to frequently asked questions, outline the penalties for non-compliance, and share actionable tips for smooth compliance.

What Is Beneficial Ownership Filing?

Definition of Beneficial Ownership

A beneficial owner is an individual who:

- Directly or indirectly owns or controls at least 25% of a company’s ownership interest.

- Exercises significant control over the company’s operations or decisions.

What Is Beneficial Ownership Filing?

Beneficial ownership filing is the process of disclosing the personal details of beneficial owners to comply with legal and regulatory frameworks.

Under the Corporate Transparency Act requirements, businesses must file Beneficial Ownership Information (BOI) with FinCEN to meet transparency standards and prevent misuse of corporate entities.

Why Is Beneficial Ownership Filing Important?

1. Combatting Financial Crime

Beneficial ownership filing addresses significant loopholes that criminals exploit for money laundering, terrorist financing, and other illicit activities.

It acts as a preventive measure, creating accountability in business ownership structures.

According to the Anti-Money Laundering Regulations by the FATF, anonymous company ownership is a major enabler of financial crime. Filing ensures this anonymity is removed, deterring fraudulent activities.

2. Meeting Corporate Transparency Act Requirements

The CTA aligns the U.S. with global transparency efforts. Filing beneficial ownership information not only meets Corporate Transparency Act requirements but also ensures that companies contribute to a cleaner, more accountable financial system.

3. Avoiding Penalties

Failure to comply with BOI report deadlines can lead to severe penalties.

Non-compliance could cost your business fines of up to $500 daily and result in criminal prosecution, including imprisonment.

How to File Beneficial Ownership Information

Understanding FinCEN Filing Requirements

To comply with FinCEN BOI report compliance, businesses must submit a Beneficial Ownership Information (BOI) report. This report includes:

1. Full legal name of each beneficial owner.

2. Date of birth.

3. Current residential address.

4.Unique identification number, such as a driver’s license or passport number.

Step-by-Step Guide to Filing

Determine Filing Obligations: Confirm whether your business falls under CTA’s scope. Certain entities, like publicly traded companies, may be exempt.

Collect Required Information: Compile accurate data for all beneficial owners.

Use FinCEN’s Reporting System: Access FinCEN’s online portal to file your BOI report.

Submit Before Deadlines: Ensure you file within the timelines specified under the CTA.

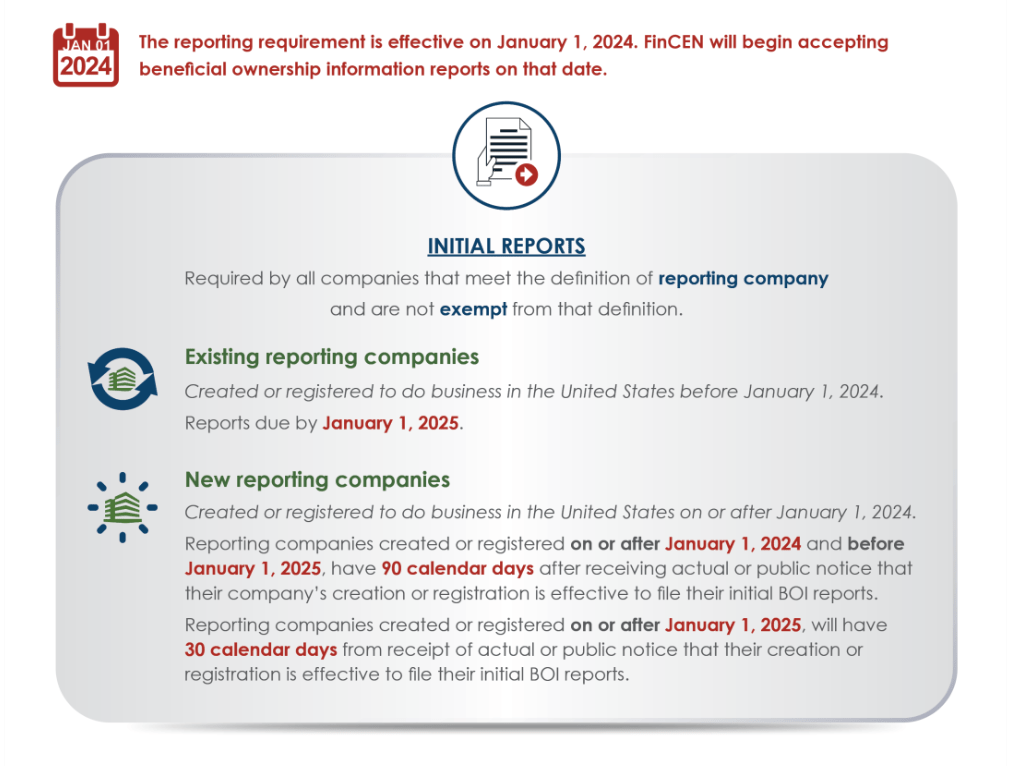

BOI Report Deadlines

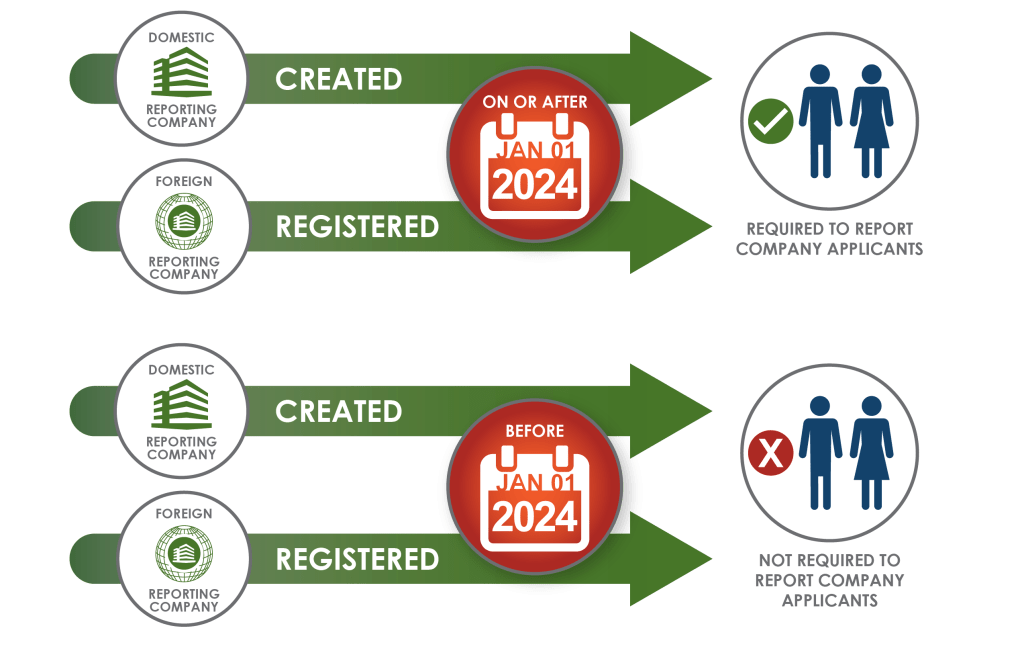

For companies created before January 1, 2024: File by January 1, 2025.

For companies registered between January 1, 2024, and January 1, 2025: File within 90 calendar days of creation or registration.

For companies created on or after January 1, 2025: File within 30 calendar days of creation or registration.

Challenges and Best Practices

Common Challenges in Beneficial Ownership Filing

Complex Ownership Structures: Identifying beneficial owners in layered ownership systems can be challenging.

Data Accuracy: Incomplete or incorrect information can lead to rejected filings.

Lack of Awareness: Many small businesses are unaware of Corporate Transparency Act requirements.

Best Practices to Overcome Challenges

Start Early: Don’t wait until deadlines approach. Begin gathering data as soon as possible.

Leverage Technology: Use compliance software to streamline the data collection and reporting process.

Consult Experts: Legal and compliance advisors can provide invaluable guidance for accurate filings.

Global Trends in Beneficial Ownership Filing

International Standards

The U.S. is not alone in its transparency efforts. The FATF and OECD have established global benchmarks for Anti-Money Laundering Regulations, requiring member nations to implement robust beneficial ownership disclosure mechanisms.

Comparison with Other Countries

United Kingdom: Operates a public beneficial ownership registry.

European Union: Requires all member states to maintain central beneficial ownership registers.

United States: Focuses on secure, non-public BOI reporting under FinCEN.

FAQs: All Your Questions About Beneficial Ownership Filing Answered

Who Must File a BOI Report?

Most businesses registered in the U.S. must comply, except exempt entities like publicly traded companies and large corporations meeting specific criteria.

What Are the Consequences of Missing Deadlines?

Penalties include fines of up to $10,000 and imprisonment for up to two years.

Can Third-Party Services Help with Filing?

Absolutely. Experts can simplify the filing process, ensuring compliance with FinCEN filing requirements.

Is Beneficial Ownership Information Publicly Accessible?

No, BOI reports filed under the CTA are confidential and accessible only to authorized government bodies.

Future of Beneficial Ownership Filing

The landscape of beneficial ownership filing is rapidly evolving. Emerging trends include:

Technology Integration: Advanced software solutions are making compliance more efficient.

Stricter Regulations: Expect more rigorous enforcement of Anti-Money Laundering Regulations globally.

Increased Collaboration: International cooperation among regulators is strengthening compliance frameworks.

Why Transparency Matters for Your Business

Transparency is not just about compliance—it builds trust with investors, customers, and regulators.

By adhering to beneficial ownership filing deadlines and penalties, your business demonstrates accountability, enhancing its reputation in the market.

Key Deadlines

| Entity Type | Deadline |

|---|---|

| Companies created before 2024 | January 1, 2025 |

| Companies registered in 2024 | 90 days after registration |

| Companies created in or after 2025 | 30 days after registration |

We’re Here to Help!

If you need support with how to file beneficial ownership information, our third-party partners can assist you in:

- Ensuring data accuracy.

- Filing BOI reports seamlessly.

- Staying updated with Corporate Transparency Act requirements.

Don’t risk penalties—let the experts handle your filings.

Conclusion

Beneficial ownership filing under the Corporate Transparency Act is a vital step toward greater corporate accountability and transparency.

With strict FinCEN filing requirements and significant BOI report deadlines, compliance should be a top priority for every business.

Act now to ensure your business stays on the right side of the law.

Contact us today to simplify the process and protect your business from potential penalties.