In the complex world of healthcare, understanding patient insurance plans is not just about patient care—it's a critical business function. This guide will clarify the key differences between HMO and PPO plans and provide a practical roadmap for managing both in your practice.

Why Understanding HMO and PPO Plans is Essential for Providers

The question of "Do doctors prefer HMO or PPO?" is more than a simple matter of preference; it's a reflection of the business realities of modern medicine. The type of insurance plan a patient has directly impacts your practice's revenue cycle, administrative workload, and the patient experience you can offer. By understanding the core mechanics of each plan, you can make informed decisions that benefit your practice and your patients.

Both PPO and HMO plans are commonplace, but they operate on fundamentally different principles. These differences affect everything from the reimbursement rates you receive to the necessary administrative steps you and your staff must take before, during, and after a patient visit. For physicians, this knowledge is not just an advantage—it’s a necessity for avoiding claim denials and ensuring a healthy revenue stream. According to a 2023 AMA study, administrative burdens like prior authorizations are a top source of physician burnout. This is where a deep understanding of these plans becomes crucial.

The PPO Advantage: Flexibility for Patients, Opportunity for Providers

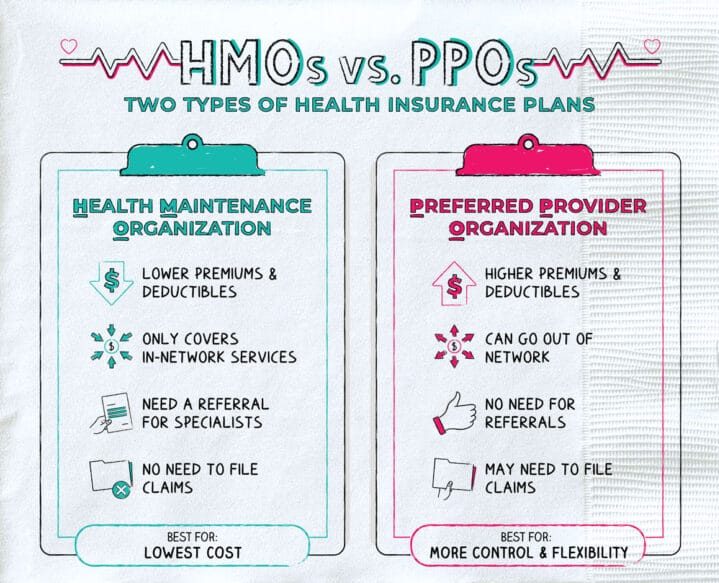

A **PPO** stands for **"Preferred Provider Organization."** This type of plan offers patients a high degree of flexibility and choice, which is a major reason why many doctors and practices prefer them. With a PPO, a patient can choose any provider they wish to see, whether that provider is "in-network" or "out-of-network." The patient is free to see specialists without a referral from a primary care physician (PCP), a key benefit that streamlines access to care.

This flexibility, however, comes at a cost to the patient. PPO plans typically have higher monthly premiums and higher out-of-pocket costs, such as co-payments and deductibles, compared to their HMO counterparts. Patients are often willing to pay this extra money for the freedom to choose their doctors and not be restricted to a specific network. This is especially true if they have an established relationship with a particular specialist or if they require care from a specific provider for a long-term health condition.

Key Characteristics of a PPO Plan for Your Practice

- Freedom of Choice: Patients are not limited to a specific network of providers. This means your practice can attract a broader patient base.

- No Referrals Required: Patients can see specialists directly without needing a referral or prior authorization, reducing administrative friction for your staff.

- Higher Reimbursement Rates: As a preferred provider, your practice can often negotiate higher reimbursement rates, leading to a more robust revenue stream.

- Simplified Claims Process: The absence of referrals and prior authorizations simplifies the billing and claims process, leading to fewer denials and faster payments.

The HMO Model: Cost Control with Network Restrictions

An **HMO** stands for **"Health Maintenance Organization."** The core principle of an HMO is to provide managed, cost-effective care through a specific network of providers. Patients with HMO plans typically enjoy lower monthly premiums, lower co-pays, and lower out-of-pocket maximums. However, this cost-saving comes with significant restrictions on patient choice.

The primary constraint of an HMO is that a patient must choose a primary care physician (PCP) who acts as a "gatekeeper" for all other medical services. To see a specialist, the patient must first obtain a referral from their PCP. If a patient seeks care from a provider outside the HMO network without a referral, the cost will likely not be covered, leaving the patient responsible for the entire bill. This can be a major point of confusion and frustration for patients and a significant administrative challenge for your practice if not handled correctly. For a more detailed breakdown of these plans, a useful resource is Investopedia's definition of HMO.

Key Challenges of an HMO Plan for Your Practice

- Limited Network: Your practice must be in-network with the specific HMO plan to be reimbursed.

- Referral and Prior Authorization: All specialist visits require a referral from the patient’s PCP, and many services require a prior authorization, adding significant administrative steps.

- Lower Reimbursement: HMO reimbursement rates are often lower than PPO rates, which can impact your practice's profitability.

- Risk of Non-Payment: If a patient is seen without the necessary referral or authorization, your practice risks non-payment and may have to bill the patient directly.

PPO vs. HMO: The Direct Impact on Your Practice

Now that we've defined both plan types, it becomes clear why many providers express a preference for PPO plans. The administrative ease, higher reimbursement potential, and broader patient base associated with PPOs make them a more attractive option. However, with the growing number of patients enrolled in HMO plans, it is not a viable business strategy to simply turn them away. A successful practice must be equipped to handle both.

PPO: The Provider Perspective

Revenue Potential: Generally higher reimbursement rates and a larger patient pool. Fewer claim denials due to administrative errors.

Administrative Burden: Significantly lower. Less time is spent on verifying referrals and obtaining prior authorizations.

Patient Flow: More seamless. Patients can book appointments with specialists directly, leading to more efficient scheduling and better patient satisfaction.

Growth Opportunity: Easier to attract new patients who value flexibility and choice in their healthcare.

HMO: The Provider Perspective

Revenue Potential: Lower reimbursement rates and a smaller, more restricted patient pool within the network.

Administrative Burden: High. Staff must meticulously check for referrals and prior authorizations, leading to increased workload and potential for costly errors. This is where effective medical credentialing becomes vital.

Patient Flow: More complex. A patient must first be seen by a PCP, then get a referral, which can delay care and create friction.

Growth Opportunity: Requires being in-network with multiple HMOs to be competitive, which is a key part of our insurance credentialing service.

The key takeaway here is that while PPO plans may be simpler from a provider’s perspective, neglecting HMO patients means turning away a significant portion of the market. The solution is not to choose one over the other but to build a robust system that can handle the complexities of both. This is especially true for modern practices, including telemedicine practices, where patients from various geographic locations and with a wide range of plans are common.

Your Administrative Checklist for a Seamless Patient Intake

To prevent claim denials and ensure your practice is properly reimbursed, your administrative staff must have a clear process for handling both HMO and PPO patients. This is the difference between a thriving practice and one that struggles with cash flow. Here is a step-by-step process you can implement today to safeguard your revenue.

The 4-Step Patient Intake Process

This simple process ensures that every patient visit is handled correctly from the start, minimizing the risk of non-payment.

- Patient Card Verification: When a new patient arrives, your staff should always ask for their insurance card. Most cards will clearly state "HMO" or "PPO" on the front.

- Eligibility and Benefits Check: If the plan type isn't clear, your staff must conduct a full eligibility and benefits check. This will confirm the plan type, determine coverage, and reveal any patient out-of-pocket costs.

- Authorization and Referral Check: If the patient has an HMO, your staff must verify that a referral or prior authorization has been obtained for the specific services being provided. This is a non-negotiable step.

- Educate the Patient: If a patient has an HMO and lacks the proper authorization or if your practice is out-of-network, you must educate them. Clearly communicate that they may be responsible for the full cost of the service. This transparency prevents billing surprises and maintains a trusting patient relationship.

The Provider and Staff Timeline

Below is a visual representation of how your team can efficiently handle patient intake to ensure proper billing and compliance. This process is key to preventing administrative headaches and protecting your practice's bottom line.

Intake & Verification

Patient arrives. Staff checks insurance card for plan type (PPO/HMO).

E&B Check

Staff confirms eligibility, benefits, and requirements (referral/auth).

Service & Education

Provider treats patient. Staff ensures patient is aware of financial responsibility.

Claims Submission

The claim is submitted with all necessary documentation, reducing the risk of denial.

Frequently Asked Questions for Providers

To help you and your staff handle common patient questions and administrative hurdles, we have compiled a list of frequently asked questions and their answers. For more information, please visit our physician credentialing FAQ page.

Generally, no. If you are not in-network with an HMO plan, you will not be reimbursed for the services you provide. There are rare exceptions, such as in emergency situations, but for a standard visit, the patient will be responsible for the entire bill. It is critical to communicate this to the patient upfront to avoid financial disputes.

A gatekeeper is the primary care physician (PCP) chosen by a patient with an HMO plan. This PCP is responsible for managing all aspects of the patient's care and must issue a referral before the patient can see a specialist. The gatekeeper model is a core component of HMOs to control costs and manage care within a specific network.

The best way to handle this burden is to implement clear, standardized protocols for your staff. Train them to always check for referrals and authorizations during the patient intake process. Furthermore, partnering with an expert service like Rxcredentialing can help streamline the entire credentialing and billing process, reducing the administrative load on your practice and staff. For more information on this, check out our guide on hiring an insurance credentialing service.

The Rxcredentialing Advantage: Your Partner in Practice Management

The complexities of navigating insurance plans, from PPO to HMO, can be overwhelming. This is where a trusted partner like Rxcredentialing becomes an indispensable asset. Our expertise in healthcare administration allows you to focus on what matters most: providing exceptional patient care. We specialize in navigating the intricate world of insurance credentialing and provider enrollment, ensuring you are properly enrolled with all the important payers in your area.

Credentialing your practice with a wide range of payers—including both HMO and PPO plans—is the key to expanding your patient base and securing your practice's financial future. From initial physician credentialing to ongoing revenue cycle management, Rxcredentialing provides comprehensive support. We help practices understand their insurance needs, manage complex payer contracts, and streamline billing processes. Our services are designed to maximize your revenue and minimize administrative burden. For a deeper dive into how we can help, explore our other services, such as our specialized billing services for small practices or our guide on medical recredentialing.

Final Thoughts: Building a Resilient Practice

While doctors often prefer PPO plans for their administrative simplicity and higher reimbursement rates, building a resilient and profitable practice requires a strategy for handling both PPO and HMO patients. By implementing clear intake protocols, educating your staff, and leveraging the expertise of partners like Rxcredentialing, you can avoid common pitfalls and ensure a steady revenue stream.

Don't let the complexities of insurance plans limit your practice's potential. Take control of your practice management by getting credentialed with the payers that matter most to your business. Visit our Work With Us page to learn more about how we can help you with all your practice management needs.