Chiropractic Credentialing Services

We handle your full chiropractic insurance credentialing and payer enrollment—CAQH setup, applications, follow-ups, and contracting—so you can reduce delays and start billing in-network with confidence.

- ✓ CAQH Setup & Re-Attestation

- ✓ Commercial & Government Payers

- ✓ Dedicated Credentialing Manager

- ✓ Accurate Applications + Follow-Ups

- ✓ EFT/ERA Setup Guidance

- ✓ Status Updates Until Approval

What Sets Us Apart

Chiropractic credentialing can get delayed by small inconsistencies (NPI, taxonomy, service locations, CAQH files, and ownership data). Our team keeps your submissions clean, complete, and payer-ready—then follows up until you receive final confirmation and effective dates. For reference on identifiers and enrollment systems, we align details using the NPPES (NPI Registry) and credentialing best-practice expectations used across major payers.

Chiropractic-Friendly Payer Strategy

We help you select the right payer mix based on your services, location, and patient demand—so you credential with plans that actually drive volume.

CAQH Accuracy + Consistency Checks

We verify your CAQH profile matches your payer applications (addresses, taxonomy, licenses, malpractice, W-9) to prevent avoidable holds.

Proactive Follow-Ups Until Final Outcome

We track status, respond to payer requests quickly, and keep your file moving until you receive approval confirmation.

Support Beyond Credentialing

Need help after you’re in-network? We also offer eligibility verification and AR recovery to protect reimbursement and cash flow.

How It Works

We run a structured credentialing workflow designed for chiropractors: collect and verify provider/practice details, build a payer-ready credential file, submit applications, and follow up until you are approved and ready to bill. Where payer rules reference Medicare-style enrollment concepts, we follow guidance tied to the CMS provider enrollment framework to keep documentation and identifiers consistent across systems.

Step 1: Intake & Credential File Setup

We collect licenses, malpractice, W-9, EIN letter (if applicable), NPIs, taxonomy, service locations, and payer targets.

Step 2: CAQH + Application QA

We update/confirm CAQH, validate details across all forms, and correct common mismatch issues before submission.

Step 3: Payer Submissions

We submit your applications based on your target networks, following each payer’s portal or paper submission rules.

Step 4: Follow-Ups, Contracting, Effective Dates

We handle payer communications, respond to requests, and confirm approval letters, effective dates, and next steps for billing readiness.

Benefits of Outsourcing

Chiropractic Credentialing Services

Medicare SPT/MPT Approval

60-day enrollment for spinal manipulative treatment (CPT 98940-98943) with proper documentation review.

Diagnosis-Specific Credentialing

Optimized for M54.5 (low back pain), M99.01 (segmental dysfunction), and S13.4 (cervical sprain) claims.

Therapeutic Procedure Setup

Proper enrollment for 97140 (manual therapy) and 97530 (therapeutic activities) with major payers.

X-Ray Requirement Navigation

Compliance with BCBS/Aetna policies requiring imaging documentation for certain manipulations.

Maintenance Care Compliance

Proper credentialing for payers with specific maintenance care limitations (e.g., UHC, Cigna).

State-Specific Scope Compliance

Ensures credentialing matches your state's physical therapy/delegation rules.

CAQH Reattestation Alerts

Quarterly reminders with pre-filled chiropractic specialty responses.

Manipulation Denial Recovery

92% success rate fixing 98940-98943 denials from incorrect credentialing.

PI/Work Comp Integration

Specialized enrollment for auto/PI cases requiring S39.012A diagnoses.

Have Other Questions? Get in Touch!

Our team is ready to guide you through every step of credentialing, contracting, and payer enrollment, making the process fast, simple, and stress-free.

The industry-standard timeline is 60 to 90 business days in most cases.

You get a dedicated credentialing manager who guides you and keeps you updated at every step.

No. You should wait for contract approvals before seeing patients.

We will need your state license, DEA, board certification, malpractice insurance, EIN Letter and a voided check to begin with the process.

We charge $140 per commercial application and $199 per government payer application. We do not charge any fee for closed panels.

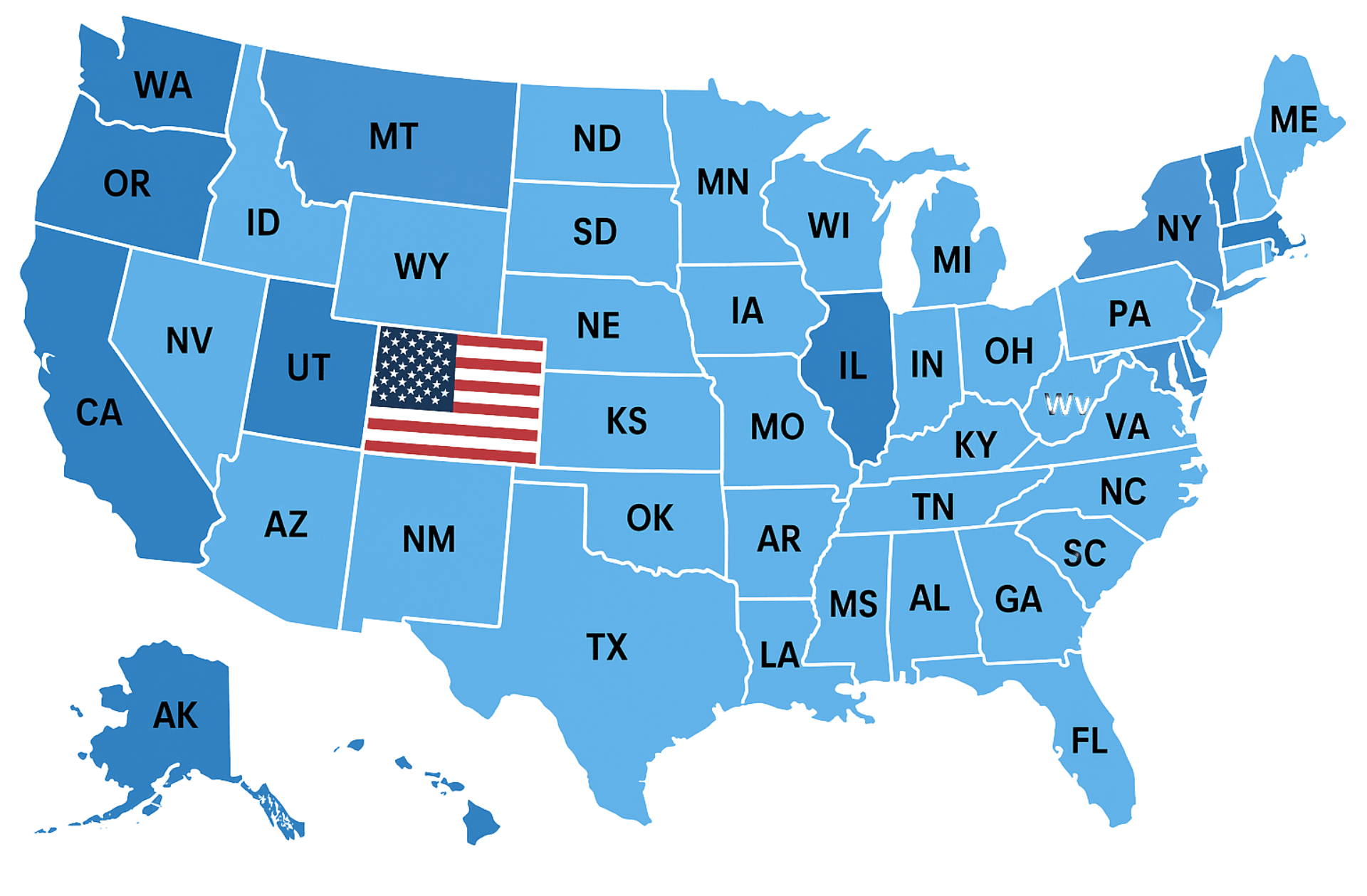

Insurance Companies We Work With

We work with every health plan in the United States, including Medicare, Medicaid, major commercial carriers like Aetna, Cigna, Humana, Blue Cross Blue Shield, UnitedHealthcare, as well as HMO, PPO, POS, state, and regional plans. Our team ensures seamless credentialing and contracting across all payers.

Trusted by Healthcare Providers Nationwide

Very attentive and efficient

Always available to explain things or answer questions or concerns

We would love to hear from you.

Contact Us

Have a question or want to learn more about our services? Fill out the form below and our team will get back to you within 24 hours.

We serve all 50 states.