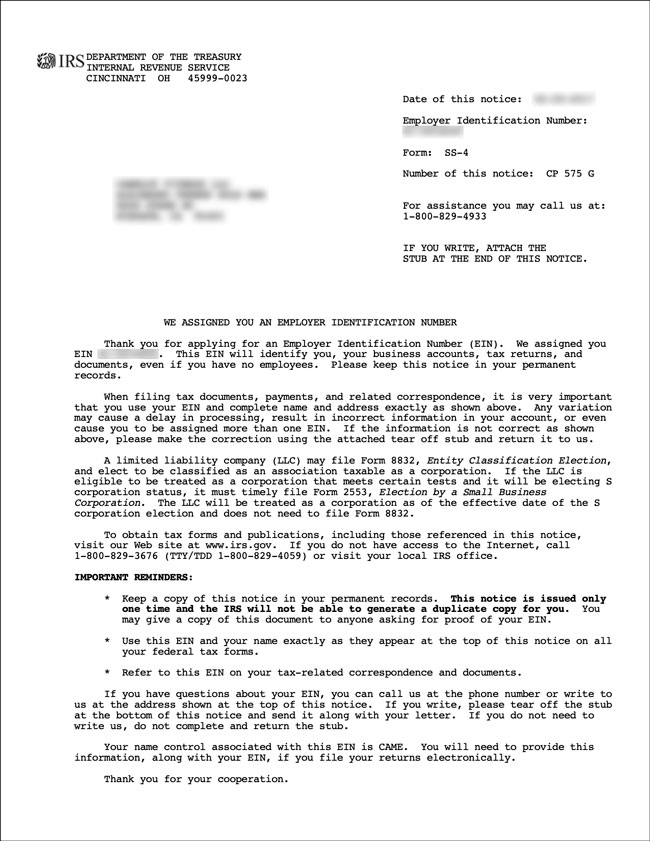

What is (CP 575) Form?

Being a medical provider, why you may need IRS EIN confirmation letter?

As a medical provider you may need EIN confirmation letter at number of occasions Such as It is required when a healthcare provider or medical practice go through provider credentialing or enrollment process.

Your business name must match with information provided on your EIN confirmation letter (CP 575).

Therefore in order to confirm that information is matching, you will have to produce this letter.

It’s also required to open a bank account if you are planning to start a medical practice or even currently trending telehealth also known as telemedicine.

A supplier or customer may also request you to produce EIN confirmation letter issued by IRS in order to confirm your Tax Id.

Your business name must match with information provided on your (CP 575), therefore in order to confirm that information is matching, you will have to produce this letter.

What if I lost my (CP 575) form?

If you need it for any reason but you did not find it where you left it.

Don’t worry, you can always contact IRS directly at (267) 941-1099.

If you are outside of United States then you may reach IRS at 800-829-4933 to request a copy in order produce a confirmation letter.

How to get copy of EIN confirmation letter?

If you lose the (CP 575) EIN confirmation letter and you contact IRS for copy of (CP 575).

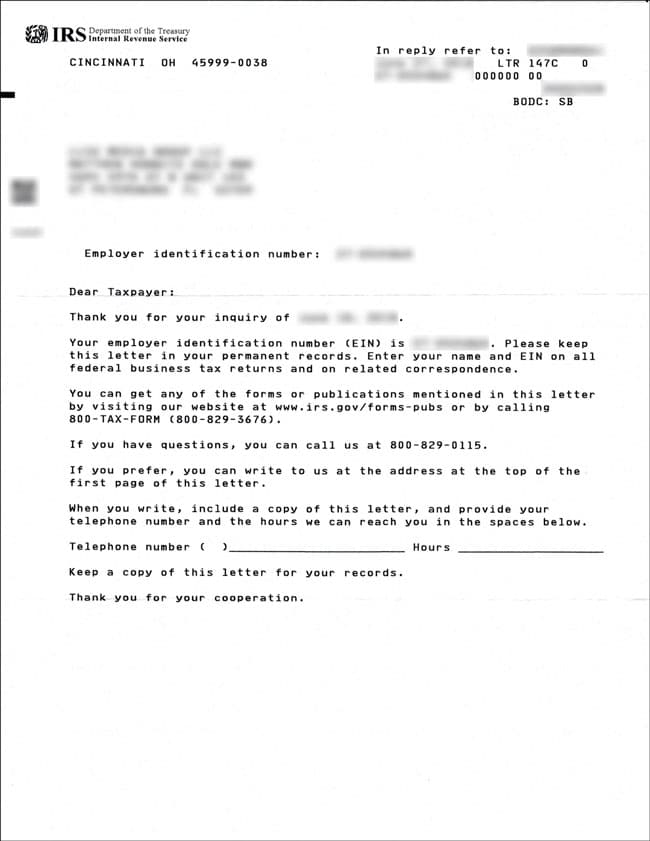

In that case you will not get copy of (CP 575) but they will send another EIN verification letter called (147C).

Is there any fee to get EIN verification from IRS?

There is no fee to get your EIN confirmation letter called (147C).

Conclusion.

It’s not a hard job to get an EIN confirmation letter even if you lose initial EIN confirmation called (CP 575).

You just need to contact IRS and ask for EIN confirmation letter called (C 147).

If you still have any confusion, you are always welcome to write us email at support@rexcredentialing.com.

Do include your phone number in your message.

Thanks you