Revenue Cycle Education | Updated for 2026 Standards

The Short Answer

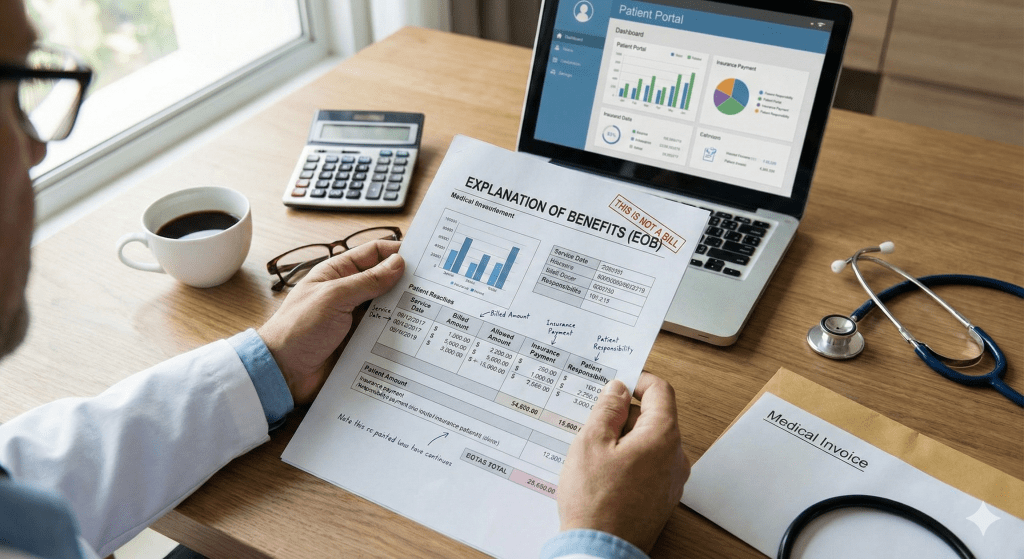

An Explanation of Benefits (EOB) is a statement sent by a health insurance company to a patient explaining what medical treatments were paid for on their behalf. It is not a bill. It clarifies the “Allowed Amount,” what the insurance covered, and the “Patient Responsibility” (Deductible/Co-pay).

For healthcare providers, the EOB’s twin brother is the ERA (Electronic Remittance Advice). While patients receive the EOB to understand their costs, your practice receives the ERA/835 file to post payments.

Confusion over EOBs is the #1 cause of patient collection disputes. When a patient receives an EOB saying “You owe $200” before your office sends the actual bill, panic often ensues. Mastering the art of explaining an EOB is a critical soft skill for any billing department.

Deciphering the Document: The Anatomy of an EOB

Every payer (Aetna, BCBS, Medicare) formats their EOB differently, but the mathematical logic is always the same. Here is the formula:

| Term | Translation for Patients | Translation for Billers |

|---|---|---|

| Billed Amount | “The sticker price.” | The Gross Charge from your CDM. |

| Allowed Amount | “The discounted price your doctor agreed to.” | The Contracted Rate (Fee Schedule). |

| Adjustment (Write-off) | “The discount you get for using an in-network doctor.” | CO-45 (Contractual Obligation). |

| Co-insurance / Deductible | “Your share of the cost.” | PR-1 (Deductible), PR-2 (Co-insurance), PR-3 (Co-pay). |

The Secret Language: CAS Codes (PR vs. CO)

When you receive an ERA (the provider’s EOB), you will see codes that explain why the full amount wasn’t paid. These are called Claim Adjustment Reason Codes (CARCs).

PR (Patient Responsibility)

Meaning: You can bill the patient for this.

- PR-1: Deductible

- PR-2: Co-insurance

- PR-3: Co-pay

CO (Contractual Obligation)

Meaning: You MUST write this off. You cannot bill the patient.

- CO-45: Charge exceeds fee schedule.

- CO-97: Bundled service (included in another payment).

If your biller mistakenly moves a CO-45 balance to the patient, you are committing “Balance Billing,” which is illegal in many states and a violation of your provider contract. This is why accurate payment posting is vital.

Get Free Credentialing with Medical Billing

Stop losing revenue to the “Credentialing Gap.” Let us handle your entire cycle.

⚠️ Why EOBs Cause Lost Revenue

The biggest risk with EOBs is Payment Posting Errors.

- The Double Adjustment: Posting the contractual write-off twice, making the patient balance look like $0 when they actually owe a co-pay.

- Ignoring Remark Codes: If an EOB says “CO-16” (Claim lacks info), this is a denial, not a write-off. Writing it off means losing revenue you could have appealed.

- Statement Delay: Waiting 30 days after the EOB arrives to bill the patient. Patients are most likely to pay within 5 days of seeing the EOB.

Frequently Asked Questions

Why is the “Billed Amount” so much higher than the “Allowed Amount”?

Providers set their “Billed Amount” (chargemaster) high to capture the maximum reimbursement from all payers. The “Allowed Amount” is the negotiated rate in your contract. The difference is simply a discount (Contractual Adjustment).

What is a Remark Code?

Remark Codes (e.g., MA130) provide extra context to the primary denial code. They might say things like “Your claim contains incomplete data.” You need both the CARC and the RARC to fix a denial.

Does Medicare send EOBs?

Yes, but they call it the Medicare Summary Notice (MSN). It is sent quarterly to patients, whereas standard EOBs are sent per claim or monthly.

How do I find the EOB online?

Providers can access ERAs/EOBs through the payer’s portal (e.g., Availity, Optum) or download the 835 file directly into their Practice Management software.

About the Author: Adam Blake

Adam has helped hundreds of healthcare providers start, grow, and sustain medical practices with his 15 years of extensive experience in the field. He specializes in revenue cycle management, payment posting accuracy, and denial prevention.