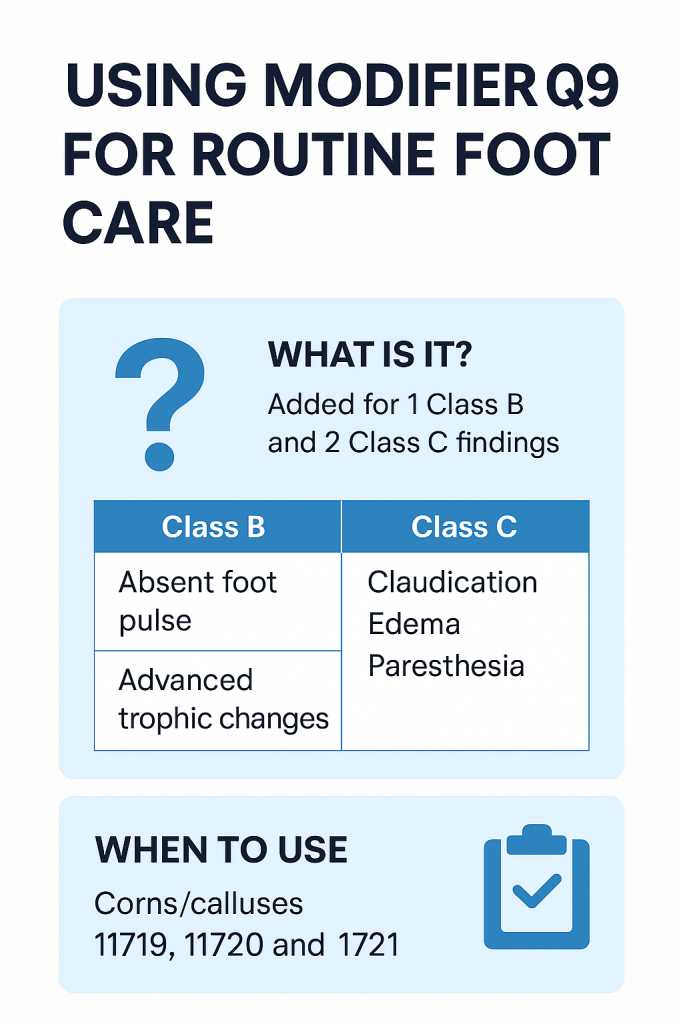

What is Modifier Q9?

Modifier Q9 is used specifically for routine foot care procedures under Medicare. It indicates that a patient has one Class B and two Class C findings documented during a physical foot evaluation. The modifier helps prove medical necessity in otherwise non-covered foot care services like callus removal or nail debridement.

✅ Modifier Q9 helps claims align with Medicare’s routine foot care coverage guidelines, ensuring the services are deemed necessary due to systemic conditions affecting the feet.

Understanding Class B and Class C Findings

To correctly use Modifier Q9, providers must identify 1 Class B and 2 Class C findings. Here’s a breakdown:

| Class | Examples of Findings |

|---|---|

| A | Non-traumatic foot amputation |

| B | Absent posterior tibial or dorsalis pedis pulse Advanced trophic changes (3+): – Skin discoloration – Shiny skin – Redness – Nail thickening – Hair loss |

| C | Claudication (pain when walking) Cold feet Edema (swelling) Paresthesia (numbness/tingling) Burning sensation |

🔎 Need more help understanding coverage? Check our guide on Modifier Q8 for Routine Foot Care Billing.

When to Use Modifier Q9

Only specific routine foot care CPT and HCPCS codes support Modifier Q9. Use it only when the criteria are met:

Covered CPT/HCPCS Codes:

- 11055–11057: Paring or cutting of benign hyperkeratotic lesions (corns/calluses)

- 11719, 11720, 11721: Trimming or debridement of nails

- G0127: Trimming dystrophic nails

💡 Also verify insurance eligibility before submitting claims to avoid unnecessary denials from non-Medicare payers.

Example: Proper Use of Modifier Q9

Scenario:

A Medicare patient visits a podiatrist with peripheral artery disease. Upon examination, the physician notes:

- Absent posterior tibial pulse (Class B)

- Claudication and edema (2 Class C findings)

The physician performs nail debridement (CPT 11721).

To support medical necessity, the claim must include Modifier Q9:

11721–Q9

✨ This coding not only justifies the procedure but also ensures faster reimbursement with reduced risk of denial.

Accurate Usage Guidelines

To minimize rejections:

- Document Thoroughly

Instead of vague terms like “poor circulation,” use specific, measurable observations:

“Absent dorsalis pedis pulse bilaterally” or “Claudication after walking 100 meters”. - Do Not Overuse or Misuse Q9

- Only use Q9 with 1 Class B + 2 Class C findings.

- If patient findings differ, consider Modifier Q7 or Q8 instead.

- Incorrect use can trigger payer audits.

Billing Tips for Modifier Q9

- Apply Modifier Q9 directly to the CPT code (e.g.,

11721–Q9). - Submit complete documentation with:

- Examination notes

- Medical history

- Method of care delivery

- Patient response and outcomes

- Cross-check with payer-specific rules. Not all insurers follow Medicare’s guidelines—Credentialing services can help clarify this for each payer.

Need Help with Podiatry Billing?

Still unsure about Modifier Q9, CPT pairings, or documentation requirements? You’re not alone. Modifier-related denials are among the top reasons for delayed or rejected claims.

✅ Our billing professionals specialize in Podiatry Medical Billing Services, ensuring accuracy, compliance, and maximum reimbursement.

Explore our most popular resources:

- How to Enroll as a Medicare Provider

- Best Behavioral Health Billing Strategies

- Mastering CAQH Credentialing

Final Thoughts

Modifier Q9 is more than just a code—it’s a critical piece of the puzzle when billing routine foot care under Medicare. With accurate documentation, proper CPT pairing, and modifier knowledge, you can streamline your billing process and avoid costly denials.

For complete credentialing and billing support, explore our specialized services: